Paul B Insurance for Beginners

When the insurance deductible amount is gotten to, added health and wellness expenditures are covered according to the stipulations of the health insurance coverage policy. For example, an employee could after that be accountable for 10% of the prices for treatment gotten from a PPO network provider. Down payments made to an HSA are tax-free to the company and also staff member, and also cash not invested at the end of the year might be rolled over to spend for future medical expenditures.

Paul B Insurance for Beginners

(Company contributions have to be the same for all workers.) Employees would be accountable for the initial $5,000 in medical costs, but they would certainly each have $3,000 in their personal HSA to pay for medical expenditures (and would have also much more if they, as well, added to the HSA). If employees or their family members tire their $3,000 HSA quantity, they would certainly pay the next $2,000 out of pocket, whereupon the insurance plan would begin to pay.

(Specific constraints may put on very compensated individuals.) An HRA needs to be funded entirely by a company. There is no limit on the quantity of money a company can add to employee accounts, however, the accounts might not be funded with worker income deferrals under a lunchroom plan. In addition, companies are not permitted to refund any kind of component of the equilibrium to workers.

Do you recognize when the most fantastic time of the year is? The enchanting time of year when you get her explanation to compare health insurance prepares to see which one is appropriate for you! Okay, you got us.

A Biased View of Paul B Insurance

When it's time to choose, it's essential to know what each strategy covers, how much it costs, and where you can use it? This things can really feel difficult, however it's much easier than it appears. We put with each other some practical knowing steps to aid you feel certain concerning your alternatives.

Emergency situation treatment is usually the exception to the rule. Pro: The Majority Of PPOs have a suitable choice of companies to choose from in your area.

Con: Greater premiums make PPOs much more expensive than other kinds of strategies like HMOs. A health maintenance organization is a health and wellness insurance plan that typically just covers care from medical professionals that work for (or agreement with) that details plan.3 So unless there's an emergency, your strategy will not spend for out-of-network care.

The Best Strategy To Use For Paul B Insurance

Even More like Michael Phelps. It's good to understand that plans in every category give some kinds of totally free preventive treatment, as well as some offer complimentary or affordable health care solutions before you fulfill your deductible.

Bronze plans have the lowest regular monthly premiums yet the highest out-of-pocket costs. As you function your way up through the Silver, Gold as well as Platinum classifications, you pay a lot more in costs, however much less in deductibles as well as coinsurance. Yet as we discussed previously, the extra expenses in the Silver category can be reduced if you get approved for the cost-sharing reductions.

Paul B Insurance Can Be Fun For Everyone

When picking your medical insurance plan, do not ignore medical care cost-sharing programs. These work practically like the other health insurance policy programs we defined already, however technically they're not a type of insurance coverage. Allow us to clarify. Health and wellness cost-sharing programs still have month-to-month premiums you pay and defined protection terms.

If you're attempting the do it yourself course and also have any type of remaining questions regarding health and wellness insurance policy strategies, the specialists are the ones to ask. And also they'll do even more than just answer your questionsthey'll also locate you the ideal cost! Or perhaps you would certainly such as a way to combine obtaining terrific health care protection with the helpful resources possibility to aid others in a time of requirement.

The Paul B Insurance PDFs

CHM aids households share health care costs like clinical examinations, pregnancy, hospitalization and surgical treatment. And also, they're a Ramsey, Trusted partner, so you recognize they'll cover the clinical costs they're intended to and also recognize your protection.

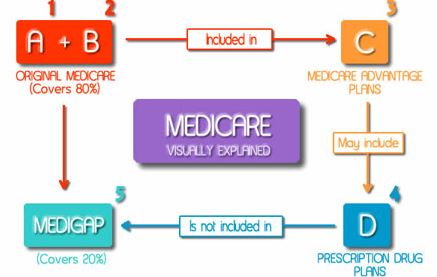

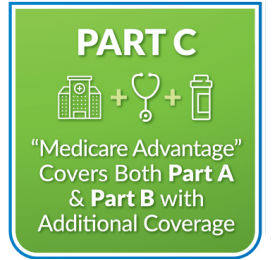

Trick Question 2 Among the things wellness care reform has carried out in the U.S. (under the Affordable Treatment Act) is to introduce even more standardization to insurance coverage plan advantages. Prior to such standardization, the benefits offered varied drastically from strategy to plan. As an example, some plans covered prescriptions, others did not.